Fixed Asset Depreciation Software

- Fixed Assets Accounting software, free download

- Fixed Asset Depreciation Software

- Free Fixed Asset Depreciation Software

- Project depreciation through the life of an asset.

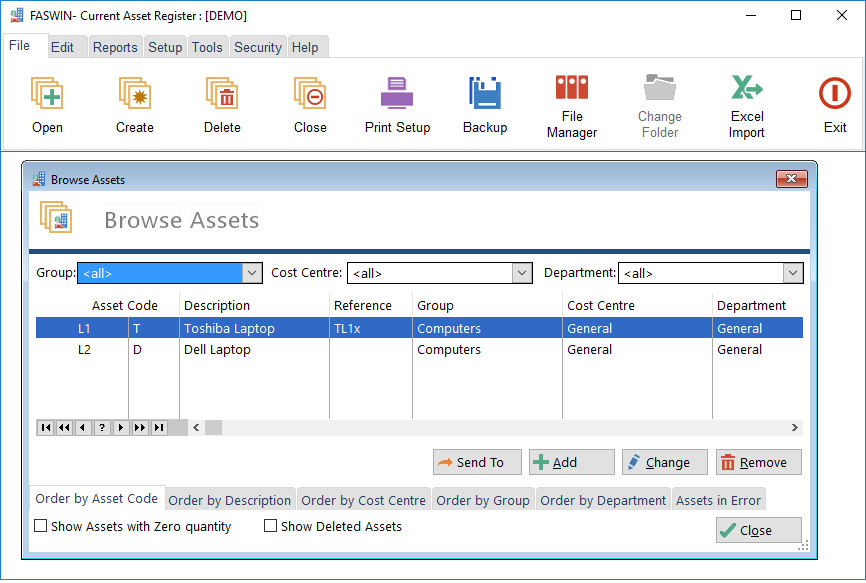

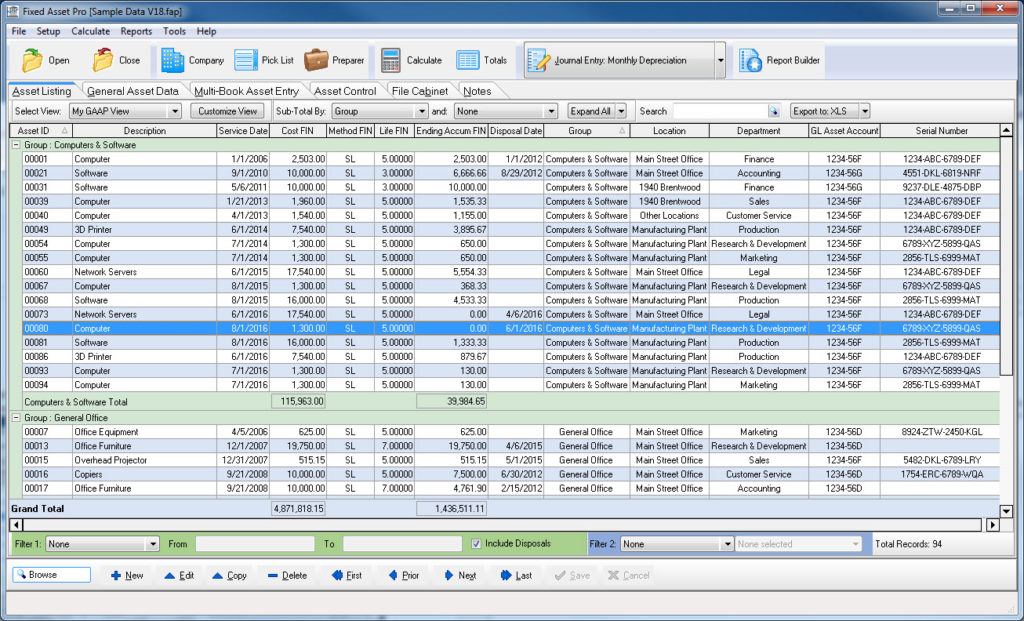

- Track an unlimited number of fixed assets.

- Handle trades and disposals of fixed assets, including sales by quantity (make asset dispositions by quantity). For example, buy ten of the same assets, and sell only one or more of the quantity.

- Asset depreciation can be recorded, stored, and calculated for assistance with income tax returns and for help planning future asset purchases.

- Easily set up client templates so you only enter common general ledger account numbers and categories once.

- Produce all listed property and luxury auto calculations and limitations.

- Historical and current depreciation methods.

- Use CenterPoint Depreciation for multiple taxpayers.

- Standalone system, or integrates seamlessly with CenterPoint Accounting software.

- Stay current with depreciation tax law changes through ongoing updates.

- Track depreciation expense by location or production center, and profit center.

- Keep track of necessary information for your fixed assets such as serial number, creditor, service date and quantity.

Fixed Assets Accounting software, free download

Fleetsmith is a mobile device management solution that runs on Apple devices—Macs. DepreciationWorks® - Book (GAAP) Depreciation Software Fixed Asset Database DepreciationWorks® is a database program for fixed assets and financial statement depreciation. Download the free 30 day.

The fundamental principles were to design Fixed Asset Depreciation software that was very easy to operate, provide for all allowable tax table depreciation methods and many additional specialized depreciation methods, yet remain flexible enough to allow for adjusting depreciation to match prior reported depreciation.

One of the main features of our depreciation software is the actual depreciation of assets. This is done one time for each book and the asset never has to be edited again unless either the business use for a particular year falls below 100% or you dispose of an asset. Any fiscal year depreciation schedule is available on demand, therefore, any time consuming 'annual recalculations or year closings' are eliminated. Print prior years depreciation schedules at any time by just entering the year to print. Our fixed asset depreciation software has been in use by C.P.A.s and small businesses since 1991. The reports have been laid out by accounting professionals to provide all pertinent information in an easy to read, usable format.

Fixed Asset Depreciation Software

The depreciation software includes the latest tax revisions for Vehicle limits, Bonus depreciation percents, and Section 179 limits. You can select 'Round' to have all depreciation amounts rounded to the closest dollar amount.

The depreciation software includes the latest tax revisions for Vehicle limits, Bonus depreciation percents, and Section 179 limits. You can select 'Round' to have all depreciation amounts rounded to the closest dollar amount. Our Asset Information and Depreciation report is one of the most informative reports available and is not available in other fixed asset depreciation software.

Free Fixed Asset Depreciation Software

This is NOT cloud based software.

All data files are stored on your system and under your complete control and security.

Approximately 125 assets using all 5 depreciation books will use about 1 meg. of disk space or

approximately 500 assets using Book & Tax depreciation will use about 2 megs. of disk space.